- My Top 12 Chrome Extensions

- NewSpring Gets a New Logo and a Lot More

- Give Wikipedia Some Class with WikiWand

- Instagram Saves Your Videos from a Case of the Jitters with New App

- The Best Car Mount for Your Mobile Phone (and It’s On Sale)

- The Best Road Trip App Available

- Track (and Accomplish) Your Goals with the new Full App

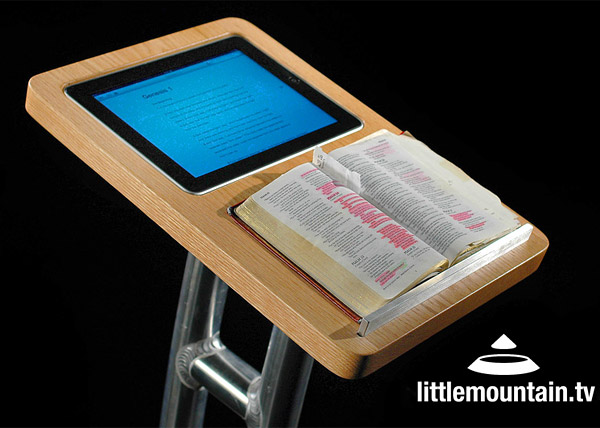

- Google Glasses at Church?

- Your New Right Arm

- Doh! The Simpsons Come to Moleskines

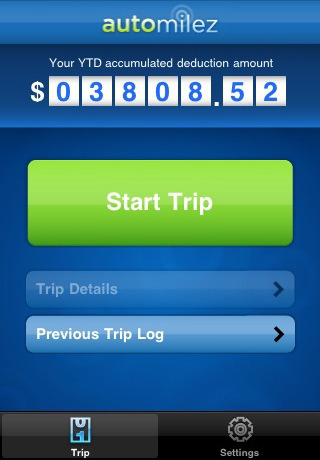

Make Some Money On Those Miles

For every mile you drive, your car loses some value. It’s called depreciation and it’s a reality of life. Of course, not all those miles are the same. The IRS deems some of those miles as tax deductible. That’s right, your pals at the IRS will let you deduct 55 cents for every mile that you use for business, 24 cents for every mile you use for medical or moving related reasons and 14 cents per mile used for charitable reasons. If you drive a lot of miles, this could really add up to some serious coin and all you’ve got to do is document when, where and why you used those miles.

For every mile you drive, your car loses some value. It’s called depreciation and it’s a reality of life. Of course, not all those miles are the same. The IRS deems some of those miles as tax deductible. That’s right, your pals at the IRS will let you deduct 55 cents for every mile that you use for business, 24 cents for every mile you use for medical or moving related reasons and 14 cents per mile used for charitable reasons. If you drive a lot of miles, this could really add up to some serious coin and all you’ve got to do is document when, where and why you used those miles.

The problem, of course, is that most of us won’t invest the energy and the effort to record all those miles and keep them separate. Well, that’s where Automilez comes in. This site and iphone app work together to make the process of recording and documenting those miles as painless as possible.

The problem, of course, is that most of us won’t invest the energy and the effort to record all those miles and keep them separate. Well, that’s where Automilez comes in. This site and iphone app work together to make the process of recording and documenting those miles as painless as possible.

The app works just like you’d think and the site generates some pretty detailed reports. The app is free but the site (which is required for the app to work) is $36 a year so you’d have to do the math to make sure the number of miles you typically put on your vehicle in a year make this app/service combo a good choice for you.

You can check it all out at Automilez.com.

DISCLAIMER: PG isn’t H&R Block and we don’t give tax advice. We understand that mileage to and from work isn’t deductible but mileage acquired while working is. Anyway, the tax code is complicated and you’d best talk to someone with some tax smarts. Still, this app could really help once you knew what you were looking to document.

Related Posts

Latest News

-

My Top 12 Chrome Extensions

Chrome is my browser of choice for a lot of...

- Posted November 5, 2014

- 4

-

Microsoft Increases OnceDrive’s Max File Size

If you’re a OneDrive user that likes BIG files then...

- Posted September 12, 2014

- 0

-

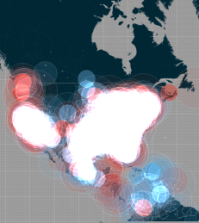

Watch Twitter Light Up as Apple Announces New Products

When Apple announces a new product it’s always big news....

- Posted September 12, 2014

- 2

-

Samsung Has Some Fun at Apple’s Expense [Video]

Whether you’re a Samsung fan or an Apple fanboy, you...

- Posted September 12, 2014

- 2

-

Release Your Inner Tycoon with the New Acorns App

Many years ago, a small site called Mint was launched....

- Posted September 6, 2014

- 2

-

The Moto 360: It’s Awesome! It’s Amazing! It’s Already Sold Out!

Motorola launched their new Moto 360 smartwatch yesterday at noon...

- Posted September 6, 2014

- 7

-

Google’s New Photo Sphere App Blows Away All Panoramic Photo Apps

Panoramic photos are cool and all but they’re so last...

- Posted September 4, 2014

- 5

Join the Fun on Facebook!

-

Microsoft Increases OnceDrive’s Max File Size

If you’re a OneDrive user that likes BIG files...

- September 12, 2014

- 0

-

Watch Twitter Light Up as Apple Announces New Products

When Apple announces a new product it’s always big...

- September 12, 2014

- 2

-

Using Mind Maps in Sermon Prep [tutorial]

In this video tutorial, I’ll show you how I...

- August 25, 2010

- 77

-

Two Great Service Planning Sites

Planning services, selecting songs and schedule volunteers can be...

- July 22, 2010

- 10